8

12 | ||||

19 | ||||

29 | ||||

39 | ||||

45 | ||||

47 | ||||

48 | ||||

50 | ||||

59 | ||||

60 | ||||

61 | ||||

62 | ||||

63 | ||||

A-1 | ||||

B-1 | ||||

AGENUS INC.

3 Forbes Road

Lexington, Massachusetts 02421

Telephone: (781) 674-4400

PROXY STATEMENT

APRIL 28, 2016April 26, 2024

This proxy statement contains information about the 20162024 Annual Meeting of Stockholders of Agenus Inc. (the “2016 Annual“Annual Meeting”), including any postponements or adjournments of the meeting. The 2016 Annual Meeting will be held virtually by live audio web conference at Agenus Inc., 3 Forbes Road, Lexington, Massachusetts 02421www.virtualshareholdermeeting.com/AGEN2024 on June 14, 201611, 2024 at 5:00 P.M.10:30 A.M., Eastern Time.

In this proxy statement, we refer to Agenus Inc. as “Agenus,” “us,” “we” or the “Company.”

Except as otherwise indicated, information in this proxy statement reflects the one-for-twenty reverse stock split of our common stock effected on April 12, 2024.

This proxy statement and solicitation is being made on behalf of the Board of Directors of Agenus Inc.

Agenus. In accordance with the “e-proxy”“notice and access” rules approved by the Securities and Exchange Commission (“SEC”) and in connection with the solicitation of proxies by our Board of Directors, on or about April 28, 201626, 2024 we first sent a Notice of Internet Availability of Proxy Materials and provided access to our proxy materials (consisting of this proxy statement, our Annual Report on Form 10-K for the year ended December 31, 20152023 and a form of proxy) over the internet to each stockholder entitled to vote at the 2016 Annual Meeting. We intend to mail to requesting stockholders full sets of our proxy materials (consisting of this proxy statement, our Annual Report onForm 10-K for the year ended December 31, 20152023 and a form of proxy) on or about April 28, 2016.26, 2024.

Our Annual Report on Form 10-K for the year ended December 31, 20152023 is also available on the “Financial” section of our corporate website athttp:https://investor.agenusbio.com/financial-information/sec-filingsand through the SEC’s EDGAR system athttp://www.sec.gov. To request a printed copy of our Annual Report onForm 10-K, which we will provide to you without charge, write to Investor Relations, Agenus Inc., 3 Forbes Road, Lexington, Massachusetts 02421. No material on our website is part of this proxy statement.

GENERAL INFORMATION ABOUT OUR VIRTUAL STOCKHOLDER MEETING

Why a virtual meeting? | We have designed the virtual format for ease of stockholder access and participation. Stockholders may vote and submit questions online during the meeting by following the instructions below. |

Who can attend the 2024 Annual Meeting? | Any Company stockholder as of the close of business on the record date, April 17, 2024, may attend the 2024 Annual Meeting. |

How do I attend the 2024 Annual Meeting? | Our Annual Meeting will begin promptly at 10:30 a.m. Eastern Time in a virtual meeting format at www.virtualshareholdermeeting.com/AGEN2024. To participate in the Annual Meeting, you will need the 16-digit control number included in your Notice Regarding the Availability of Proxy Materials, your proxy card or on the instructions that accompanied your proxy materials. We encourage you to access the meeting prior to the start time. Online check-in will start 15 minutes before the meeting, and you should allow ample time for the check-in procedures. If your shares are held in a bank or brokerage account, instructions should also be provided on the voting instruction form provided by your bank or brokerage firm. |

If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest,” but you will not be able to vote or ask questions. | |

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual Annual Meeting website? | We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting log-in page. |

2

VOTING PROCEDURES

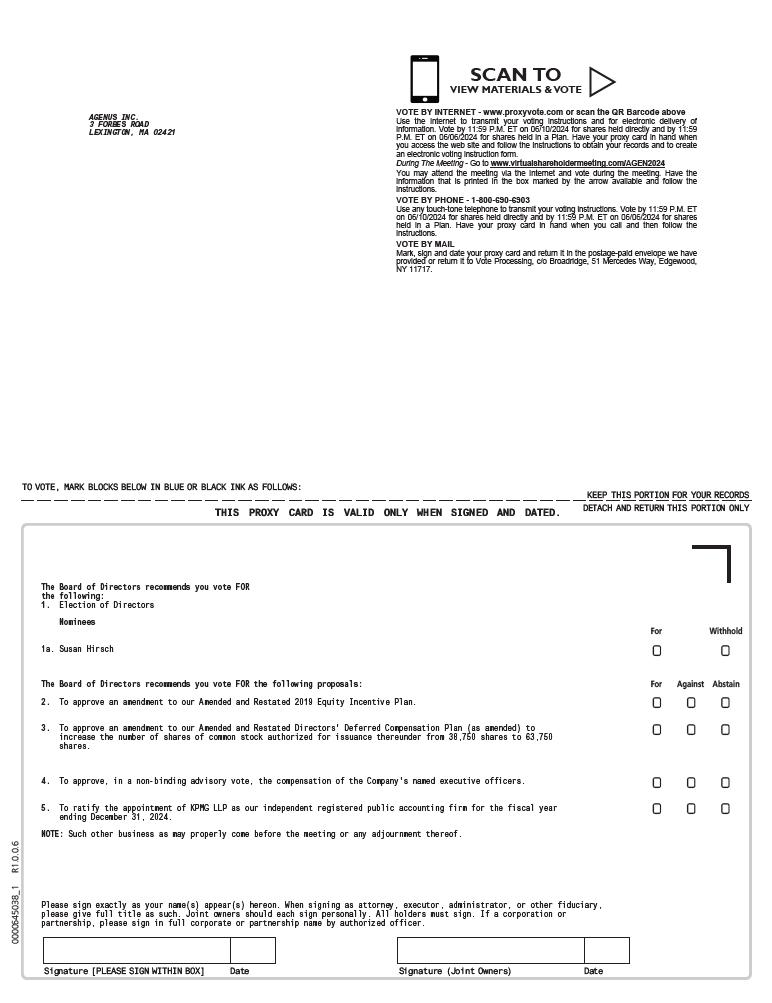

YOUR VOTE IS IMPORTANT. PLEASE TAKE THE TIME TO VOTE.Stockholders have a choice of voting over the internet, by telephone, by mail using a proxy card, or in person atby attending the 20162024 Annual Meeting. Please refer to the proxy card or other voting instructions included with these proxy materials for information on the voting methods available to you.If you vote over the internet, by telephone, or in personvirtually at the 20162024 Annual Meeting, you do not need to return your proxy card.

Who can vote? | Each share of our common stock that you owned as of the close of business on April | |

Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of printed proxy materials? | Pursuant to the “notice and access” rules adopted by the SEC, we provide stockholders access to our proxy materials over the internet. Accordingly, we sent a Notice of Internet Availability of Proxy Materials (“Notice”) to all of our stockholders as of the record date. The Notice includes instructions on how to access our proxy materials over the internet and how to request a printed copy of these materials. In addition, by following the instructions in the Notice, stockholders may request to receive proxy materials in printed form by mail or electronically by Choosing to receive your future proxy materials by | |

What is the difference between holding shares directly in my name and holding shares in “street name”? | If your shares are registered directly in your name with our transfer agent, If your shares are held for you in an account by a broker, bank, or other nominee, you are considered the beneficial owner of shares held in “street name.” | |

How do I vote? | If your shares are registered directly in your name, you may vote:

|

| 10, 2024. If your shares are held in a Company stock plan and you wish to vote over the telephone, your vote must be received by 11:59 P.M. Eastern Time on June 6, 2024. | ||

• By mail. Complete and sign the enclosed proxy card and mail it in the enclosed postage prepaid envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. The proxy card delivered by mail must be received on or prior to June 10, 2024. Your shares will be voted according to your instructions. If you do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. |

3

• At the If your shares are registered in “street name,”you have the right to direct your broker, bank, or nominee how to vote your shares by using the voting instruction card included in the mailing, or by following their instructions for voting over the internet or by telephone. | ||

How can I change my vote? | If your shares are registered directly in your name,you may revoke your proxy and change your vote at any time before the • Vote over the internet as instructed above. Only your latest internet vote is counted. • Vote by telephone as instructed above. Only your latest telephonic vote is counted. • Sign a new proxy card and submit it as instructed above. • Attend the If your shares are held in “street name,”you may submit new voting instructions by contacting your broker, bank, or nominee. You may also vote | |

Will my shares be voted if I do not return my proxy? | If your shares are registered directly in your name,your shares will not be voted if you do not vote over the internet, vote by telephone, return your proxy, or vote If your shares are held in “street name,”your broker, bank, or nominee, under certain circumstances, may vote your shares for you if you do not return your proxy. A broker, bank, or nominee has authority to vote customers’ unvoted shares on some routine matters. If you do not give a proxy to your broker, bank, |

4

or nominee to vote your shares, it may either vote your shares on routine matters, or leave your shares unvoted. Proposal |

What does it mean if I receive more than one proxy card? | It means that you have more than one account, which may be at the transfer agent or brokers. Please vote over the internet or by telephone, or complete and return all proxies for each account to ensure that all of your shares are voted. | |

How many shares must be present to hold the | A majority of our outstanding shares of common stock as of the record date must be present at the If a quorum is not present, the | |

What vote is required to approve each matter and how are votes counted? | Proposal 1—To elect The Proposal 2—To approve an amendment to our Amended and Restated 2019 Equity Incentive Plan. To approve Proposal 2, a majority of the votes cast by stockholders present in person or represented by proxy at the 2024 Annual Meeting and voting on the matter must vote FOR Proposal 2. If your shares are held by your broker, bank, or nominee in “street name” and if you do not vote your shares or instruct your broker, bank, or nominee how to vote with respect to this item, your unvoted shares will be counted as “broker non-votes.” Abstentions and “broker non-votes” | |

Proposal | ||

| 63,750 shares. To approve Proposal 3, a majority of the votes cast by stockholders present in person or represented by proxy at the | ||

5

Proposal 4—To approve, | ||

| in a non-binding advisory vote, the compensation of the Company's named executive officers. To approve Proposal 4, a majority of the votes cast by stockholders present in person or represented by proxy at the | ||

Proposal 5—To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, | ||

| 2024. To approve Proposal 5, a majority of the votes cast by stockholders present in person or represented by proxy at the | ||

How does the Board of Directors recommend that I vote? | Our Board of Directors recommends that you vote: • FOR Proposal 1—To elect the nominated Class • FOR Proposal 2—To approve an amendment to our Amended and Restated • FOR Proposal 3—To approve an amendment to our Amended and Restated Directors’ Deferred Compensation Plan (as amended) to increase the number of shares of common stock authorized for issuance thereunder from 63,750 shares. •

FOR Proposal 4—To approve, in a non-binding advisory vote, the compensation of the Company's named executive officers. • FOR Proposal 5—To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, | |

Are there other matters to be voted on at the | We do not know of any other matters that may come before the | |

6

Where do I find the voting results of the | We will report the voting results in a Current Report on Form 8-K to be filed with the SEC within four business days after the end of the | |

Who bears the costs of soliciting these proxies? | We will bear the costs of soliciting proxies. In addition to the mailing of these proxy materials, our directors, officers, and employees may solicit proxies by telephone, | |

How can I receive future proxy statements and annual reports over the internet instead of receiving printed copies in the mail? | This proxy statement and our Annual Report on Form 10-K for the year ended December 31, | |

If your shares are registered directly in your name,you can choose this option when you vote over the internet and save us the cost of producing and mailing these documents. You can also choose to view future proxy statements and annual reports over the internet. Your election to receive proxy materials by If your shares are held in “street name,”you should check the information provided by your broker, bank, or other nominee for instructions on how to elect to view future proxy statements and annual reports over the internet. No material on our website is part of this proxy statement. |

7

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors has nominated the individuals listed belowSusan Hirsch for election as Class I directors. EachIII director. The nominee currently serves as a Class III director.

Our Board of Directors (the “Board”) is divided into three classes. One class is elected each year and members of each class hold office for three-year terms. The Board currently consists of six members. Two members are Class I directors, with terms expiring at the 20162025 Annual Meeting.Meeting of Stockholders. Two members are Class II directors, with terms expiring at the 20172026 Annual Meeting of Stockholders.Meeting. Two members are Class III directors, with terms expiring at the 20182024 Annual Meeting of Stockholders. One current Class III director, Allison Jeynes-Ellis, who has served as a director of the Company since 2018, notified the Board on April 22, 2024 that she would decline to stand for reelection and, as a result, would resign from the Board effective immediately prior to the 2024 Annual Meeting. Following receipt of Dr. Jeynes-Ellis's notice, on April 24, 2024, Susan Hirsch, then a Class II director, resigned from the Board solely for the purpose of rebalancing the Board and was concurrently re-appointed by the Board as a Class III director effective immediately. The Board has nominated Brian Corvese and Timothy R. Wright, each of whom is a current Class I director,Susan Hirsch, for re-election to a term as a Class III director, expiring at the 20192027 Annual Meeting of Stockholders.

For more information on nomination of directors, see “Corporate Governance and Nominating Committee” below in the section entitled “Our Corporate Governance—Committees of the Board.”

Your vote is requested in favor of Brian Corvese and Timothy R. Wright, the nominees listed below,Susan Hirsch as a Class I directors.III director. The nominees havenominee has indicated theirher willingness to serve, if elected, but if theyshe should be unable or unwilling to serve, proxies may be voted for substitute nominees designated by the Board.

There are no family relationships between or among any of our executive officers, directors, or nomineesnominee for directors.director.

Below are the names and certain information about each member of the Board, including Susan Hirsch, the nomineesnominee for election as a Class I directors:III director:

NOMINEES FOR CLASS III DIRECTORS—TERMS TO EXPIRE IN 2024

Susan Hirsch Age: 71 Director since 2020 (a) Audit and Finance Committee | Ms. Hirsch has over 40 years of experience in investment management and finance. Until February 2021, she was a Managing Director and Portfolio Manager at Nuveen, a TIAA company, where she was responsible for managing over $20 billion in assets including the TIAA-CREF Large-Cap Growth Fund with $6.6 billion in assets. Prior to joining Nuveen in 2005, she served as Executive Vice President and Portfolio Manager for the Mid-Cap Growth and Technology Sector portfolios as Jennison Associates. Ms. Hirsch’s previous experience also includes investment management positions at Lehman Brothers Global Asset Management and Delphi Asset Management as a Senior Portfolio Manager for the Selected Growth Stock Portfolio. She began her career as an analyst at Smith Barney and Lehman Brothers where the success of her quantitative model led to her subsequent recognition as a top ranked Institutional analyst for small cap growth stocks in 1991, 1992 and 1993. Ms. Hirsch holds a BS in Accounting from Brooklyn College. Ms. Hirsch qualifies as an audit committee financial expert and brings extensive investment and financial experience to our Board. |

8

CLASS II DIRECTORS – TERMS TO EXPIRE IN 2026

Garo H. Armen, Ph.D. Age: 71 Founder and Chairman and Chief Executive Officer of Agenus Inc. Director since 1999 (a) Executive Committee | Dr. Armen is Chairman and Chief Executive Officer of Agenus Inc., which he co-founded in 1994. Dr. Armen brings to our Board a deep historical and practical knowledge of the business of the Company and its technologies, as well as years of expertise in the financial and biopharmaceutical arenas. From mid-2002 through 2004, he was Chairman of the Board of Directors for the biopharmaceutical company Elan Corporation, plc which he helped restructure. Dr. Armen currently serves as executive Chairman of the Board of Directors of Protagenic Therapeutics, Inc., a publicly held biotechnology company and as the Chairman of the Board of MiNK Therapeutics, Inc., a publicly traded affiliate of Agenus. Dr. Armen is also the founder and Chairman of the Children of Armenia Fund, a philanthropic organization established in 2000 that is dedicated to the positive development of the children and youth of rural Armenia. He holds a Ph.D. degree in physical organic chemistry from the City University of New York. |

Ulf Wiinberg Age: 65 Director since 2016 (a) Audit and Finance Committee (Chair) (b) Corporate Governance and Nominating Committee | Mr. Wiinberg has almost 20 years of senior leadership experience. Mr. Wiinberg previously served as Chief Executive Officer of H. Lundbeck A/S (“Lundbeck”) from June 2008 to December 2014. Lundbeck is a global pharmaceutical company developing and marketing treatments for psychiatric and neurological disorders. He previously served on the boards of several health care industry associations and held multiple executive roles at Wyeth, one of the world’s largest research- driven pharmaceutical companies that was acquired by Pfizer in 2009. He served as President of Wyeth Europe, Africa and Middle East; President of Consumer Healthcare; Managing Director of Wyeth UK, and in various commercial positions. Mr. Wiinberg currently serves on the boards of UCB SA, a global biopharmaceutical company based in Belgium, Hansa Medical AB (Chairman), a Swedish biopharmaceutical company, Alfa Laval AB, a Swedish industrial company, and MiNK Therapeutics, Inc., an affiliate of Agenus. Mr. Wiinberg qualifies as an audit committee financial expert and brings to our Board years of experience in the biotechnology, pharmaceutical and healthcare industries internationally as well as extensive financial and corporate governance experience. |

9

CLASS I DIRECTORS—TERMS TO EXPIRE IN 20162025

Brian Corvese Age: President and Founder of Vencor Capital Director since 2007 (a) (b) Corporate Governance and (c) Executive Committee (Chair)

| Since 1999, Mr. Corvese has been the President and Founder of Vencor Capital (“Vencor”), a private equity firm with telecommunications and technology investments in the Middle East and Mediterranean regions. Prior to working at Vencor, Mr. Corvese worked on investments in the U.S. and global equity markets as a Managing Director and partner at Soros Fund Management, the largest hedge fund in the world at the time. From 1988 to 1996, Mr. Corvese was a partner at Chancellor Capital Management (“Chancellor”), a $25 billion money management firm. While at Chancellor, Mr. Corvese was a Portfolio Manager with responsibility for investments made in basic industries, restructurings, and special situations, corporate governance investments, as well as founded and managed his own hedge fund. From 1981 to 1988, Mr. Corvese was with Drexel Burnham Lambert (“Drexel”) as an equity analyst following the chemical and specialty chemical industries and participated in a significant number of merger and acquisition activities. While at Drexel, Mr. Corvese was a member of the top chemical and specialty chemical research team, as ranked by Institutional Investor. Mr. Corvese currently serves on the Board of Directors of MiNK Therapeutics, Inc., the National Telecommunications Corporation, based in Cairo, |

Timothy R. Wright Age:

Director since 2006, Lead Director since 2009 (a) Compensation Committee (b) Corporate Governance and Nominating Committee (Chair)

(c) Audit and Finance Committee

(d)

| Mr. Wright is | |

Mr. Wright brings to our Board over |

CLASS II DIRECTORS—TERMS TO EXPIRE IN 2017

|

|

CLASS III DIRECTORS—TERMS TO EXPIRE IN 2018

| ||

| ||

Vote Required

The two nomineesnominee for director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Abstentions and “broker non-votes” are not counted for purposes of electing directors. If your shares are held by your broker, bank, or nominee in “street name” and if you do not vote your shares or instruct your broker, bank, or nominee how to vote with respect to this item, your unvoted shares will be counted as “broker non-votes.” “Broker non-votes” are not counted for purposes of electing directors. You may vote FOR alleach of the nominees, WITHHOLD your vote from alleach of the nominees or WITHHOLD your vote from any one of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors and will have no effect on the results of the vote.

10

The Board of Directors recommends a vote FOR each of the nomineesnominee for Director.

OUR CORPORATE GOVERNANCE

Our Commitment to Good Corporate Governance

We believe that good corporate governance and an environment of high ethical standards are importantessential for Agenus to achieve business success and to create value for our stockholders. OurThe Board is committed to high governance standards and to continually working to improve them. We continue toregularly review our corporate governance practices in light of ongoing changes in applicable law and evolving best practices.

Role of Our Board

Our

The Board monitors our overall corporate performance, the integrity of our financial controls, risk management and legal compliance procedures. It appoints senior management and oversees succession planning and senior management’s performance and compensation. The Board also oversees our short- and long-term strategic and business planning, and reviews with management its business plan, financing plans, budget, and other key financial and business objectives.

Members of the Board keep informed about our business through discussions with our Chief Executive Officer and other members of our senior management team, by reviewing materials provided to them by the Companymanagement on a regular basis and in preparation for Board and committee meetings, and by participating in meetings of the Board and its committees. WeSenior management regularly reviewreviews key portions of our business and its progress with the Board. These practices afford the Board members the opportunity to actively participate in risk management assessment and raise questions and engage in discussions with management regarding areas of potential risk and opportunities to mitigate such risk. The Audit and Finance Committee of the Board reviews the risk management practices of the Company and in particular the Company's approach to cyber risks and mitigation efforts, and both the Corporate Governance and Nominating Committee and the Audit and Finance Committee receive an annual reportperiodic updates from the Company’s Chief Compliance Officersenior management outlining areas of compliance focus and proposed recommendations. Additionally, the Compensation Committee reviews the Company’s executive compensation program and the incentives created by the executive compensation program, to assess whether our compensation arrangements encourage excessive risk takingor properly calibrate risk-taking by our executives.

We introduce our senior executives and other strategic employees to the Board so that the Board can become familiar with our key talent. Timothy R. Wright, our Lead Director, introduces each new Board member to our Corporate Governance policies and their responsibilities to the Company as a director. Each Board member receives a Board of Directors handbook that provides the director with a summary of these practices and policies.

Board Meetings and Attendance

In 2015,2023, the Board met teneight times and acted by written consent twice.four times. During 2015,2023, each of our directors, except for Dr. Jeynes-Ellis, attended at least 75% of (i) the total number of meetings of the Board held during the period during which the director served and (ii) all meetings of committees of the Board on which the director served, during the periods the director served. In 2015, allperiod in which they were directors. All of our Board members attended our 20152023 Annual Meeting of Stockholders. We expect eachall of our continuing Board members to attend the 20162024 Annual Meeting.

Governance Guidelines

The Board is guided by our Guidelines on Significant Corporate Governance Issues (our “Governance Guidelines”). We believe our Governance Guidelines demonstrate our continuing commitment to good corporate governance. The Board reviews our Governance Guidelines from time to time, as needed, and at least once annually.when significant developments warrant a new review. Our Governance Guidelines are posted on the corporate governance section of our website athttp:https://investor.agenusbio.com/corporate-governance. No material on our website is part of this proxy statement.

Performance of Our Board

We consider it important to continually evaluate and improve the effectiveness of the Board, its committees and its individual members. We do this in various ways. Each year, the Lead Director surveys the Board members to assess the effectiveness of the Board and its committees. Using these surveys, the Lead Director

assesses the Board’s performance and the performance of individual members, and reports his conclusions to the full Board. The assessment also evaluates the Board’s effectiveness in reviewing

12

executive management, conducting appropriate oversight and adding value to Agenus. Each of the Board’s standing committees also conducts annual self-evaluations.

At each Board meeting, each Board member has the opportunity to assess the effectiveness of the materials presented and the conduct of the meeting, and to offer suggestions for improvement at future meetings.

Code of Business Conduct and Ethics and Securities Trading Policies

The Board originally adopted our Code of Business Conduct and Ethics (the “Code of Ethics”) in 2003. The Board reviewed, revised, and updated the Code of Business Conduct and Ethics most recently in December 2015.January 2024. The Code of Business Conduct and Ethics applies to all members of the Board and all employees of Agenus, including our Chief Executive Officer, Chief Financial Officer and Principal Financial and Accounting Officer. In addition, Agenus has a Securities Trading Policy, which was updated and reviewed and approved by the Board in January 2023. Among other matters, both our Code of Business Conduct and Ethics prohibitsand Securities Trading Policy prohibit the members of the Board and all employees of Agenus from buying or selling our securities while in possession of material, non-public information about the Company. Our Code of Business Conduct and Ethics isand Securities Trading Policy are each posted on the corporate governance section of our website athttp:https://investor.agenusbio.com/corporate-governance. No material on our website is part of this proxy statement. We intend to post on our website all disclosures that are required by law or NASDAQNasdaq listing rules concerning any amendments to or waivers from, our Code of Business Conduct and Ethics. Stockholders may request a free printed copy of our Code of Business Conduct and Ethics by writing to Investor Relations, Agenus Inc., 3 Forbes Road, Lexington, MA 02421.

ESG Charter

As an immuno-oncology company, we are driven by our commitment to help patients of today and tomorrow by developing medicines that seek to extend and improve quality of life. As we do so, our vision inspires us to support a sustainable Environmental, Social and Governance ("ESG") strategy; one where the planet is healthy, people thrive, and society is inclusive. In February 2023, we issued our inaugural ESG Charter, which outlines the Company's commitment and process for defining and measuring progress of our stated commitment to environmental stewardship and sustainability, corporate social responsibility and corporate governance. Our Environmental, Social, Governance Charter is posted on the corporate governance section of our website at https://investor.agenusbio.com/corporate-governance. No material on our website is part of this proxy statement.

Compensation Recoupment Policy

In June 2023 we adopted a Policy for Recoupment of Executive Incentive Compensation in the Event of Accounting Restatement (the “Compensation Recoupment Policy”), in compliance with the requirements of the Dodd-Frank Act, final SEC rules and applicable Nasdaq listing standards, which covers our current and former executive officers. Under the Compensation Recoupment Policy, if we are required to prepare an accounting restatement due to material errors or noncompliance with any financial reporting requirements under the securities laws, certain incentive-based compensation paid or awarded to covered executives will be subject to reduction and/or repayment if the amount of such compensation was calculated based on the achievement of financial results that were the subject of the restatement and the amount of such compensation that would have been received by the covered executives had the financial results been properly reported would have been lower than the amount actually awarded.

Independence of Directors

Our Governance Guidelines and NASDAQNasdaq listing rules provide that a majority of the Board should be composed of independent directors. The Corporate Governance and Nominating Committee annually reviews the independence of the directors and reports to the Board which directors it recommends that the Board determine are independent. The Board then makes the final determination. The Board takes into account NASDAQNasdaq listing rules, applicable laws and regulations, and other factors in making its determinations including potential conflicts of interest, related party transactions, and other relationships that would reasonably be expected to compromise a director’s independence. The Board has determined that Mr. Corvese, Ms. Hirsch, Dr. Jeynes-Ellis, Mr. Jordan, Dr. Malik, Ms. Sharp,Wiinberg, and Mr. Wright are currently independent directors. Dr. Armen is currently not an independent director because he is employed as our Chief Executive Officer. In making independence determinations with regard to other directors, the Board considered related party transactions between us and a director or a director’s affiliates and any positions a director holds with entities with commercial relationships with us.

Executive Sessions of Independent Directors

Our independent directors typicallyperiodically meet in executive session without management present immediately prior toafter regularly scheduled Board meetings and at least quarterly.meetings. Four such meetings were held during 2015.2023.

13

Leadership Structure of the Board

Mr. Wright, an independent director, serves as the Lead Director of the Board and as Chair of the Corporate Governance and Nominating Committee. Mr. Wright also serves on the Compensation Committee, the Audit and Finance Committee and the Business & Development AdvisoryExecutive Committee. In addition to the duties of all directors, the specific responsibilities of the Lead Director include: (i) acting as chair of the Corporate Governance and Nominating Committee; (ii) developing the agenda for and presiding over all executive sessions of the independent directors; (iii) acting as principal liaison between the independent directors and the Chief Executive Officer on sensitive issues and raising at any meeting of the Board items that are not appropriately or best put forward by the Chief Executive Officer; and (iv) communicating to the Chief Executive Officer the independent directors’ annual evaluation of the Chief Executive Officer. The Company’s Chief Executive Officer

serves as the Chairman of the Board. We believe that the Company’s Chief Executive Officer is best situated to serve as Chairman because he is the director most familiar with the Company’s business, and most capable of effectively identifying strategic priorities and leading the discussion and execution of our Company’s strategy. Our independent directors and management have different perspectives and roles in strategy development. The Company’s independent directors bring experience, oversight, and expertise from outside the Company and from inside and outside the Company’s industry, while the Chief Executive Officer brings Company-specific experience and expertise. To assure effective independent oversight, the Company has adopted a number of governance practices, including:

•

•

•

While there may be circumstances in the future that would lead the Company to separate the offices of Chairman and Chief Executive Officer, we do not believe this is currently necessary due to the nature and size of the operations of the Company, the overall independence of the Board from management, and the strength of the Lead Director’s role on the Board.

Committees of the Board

The Board currently has five standing committees: the Audit and Finance Committee, the Compensation Committee, the Corporate Governance and Nominating Committee, the Business & Development AdvisoryAffiliate Transactions Committee and the Non-Executive Equity AwardExecutive Committee. The Board also appoints from time to time ad hoc committees to address specific matters.

Audit and Finance Committee

|

Members:

Ulf Wiinberg, Chair

Susan Hirsch

Timothy R. Wright

The Audit and Finance Committee consists entirely of independent directors within the meaning of the NASDAQNasdaq listing rules and the requirements contemplated by Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “1934 Act”). The Board has determined thatDuring the entirety of 2023, Mr. Corvese, ChairWiinberg (Chair), Mr. Wright and Ms. Hirsch were members of the Committee, and Dr. Malik each qualify as audit committee financial experts. For a description of Mr. Corvese and Dr. Malik’s relevant experiences that qualify them as audit committee financial experts, please see their biographies on page 7 and page 9, respectively. During 2015, the Audit and Finance Committee consisted ofCommittee. The Board determined that Mr. Corvese (Chair), Dr. Malik, Mr. Wright and Tom Dechaene. Mr. Dechaene retired from the Board on December 31, 2015, and Dr. Malik joined the Audit and Finance Committee on June 25, 2015.Wiinberg qualifies as an audit committee financial expert. The Audit and Finance Committee’s primary function is to assist the Board in monitoring the integrity of our consolidated financial statements and our system of internal control. The Audit and Finance Committee has direct responsibility for the appointment, independence, and monitoring of the performance of our independent registered public accounting firm. The committee is responsible for pre-approving any engagements of our independent registered public accounting firm.firm, and all related party transactions. The committee also reviews our risk management practices, cyber-security program and mitigation, strategic tax planning, preparation of quarterly and annual financial reports, and compliance processes.

The Audit and Finance Committee members meet regularly with our independent registered public accounting firm, without management present and with members of management in separate private sessions, to discuss any matters that the committee or these individuals believe should be discussed privately with the

committee, including any significant issues or disagreements concerning our accounting practices or consolidated financial statements. The committee also reviewsreviewed and approved the Code of Ethics annually, and periodically meets with our Chief Compliance Officer.Company's Securities Trading Policy, among others, in 2023. The committee conducts a meeting each quarter to review our consolidated financial statements prior to the public release of earnings. The committee has the authority to engage special legal, accounting or other consultants to advise the committee. The committee also has the authority to delegate to subcommittees any responsibilities of the full

14

committee. The Audit and Finance Committee charter is posted on the corporate governance section of our website athttp:https://investor.agenusbio.com/corporate-governance. corporate-governance.No material on our website is part of this proxy statement. Please also see the Report of the Audit and Finance Committee on page 69.

Compensation Committee

|

Members:

Brian Corvese, Chair

Timothy R. Wright

Susan Hirsch

The Compensation Committee consists entirely of independent directors within the meaning of applicable NASDAQNasdaq listing rules.rules and “non-employee directors” for purposes of Rule 16b-3 under the 1934 Act. During the entirety of 2015,2023, Mr. JordanCorvese (Chair), Mr. CorveseDr. Jeynes-Ellis, and Mr. Wright were members of the Compensation Committee. The Board appointed Ms. Hirsch to replace Dr. Jeynes-Ellis on the committee after Dr. Jeynes-Ellis submitted her resignation to the Board. The committee’s primary responsibilities arepurpose is to addressapprove, administer and interpret our executive, officers’key employee and other key employees’ development, retention,director compensation programs, benefit policies, compensation philosophy and performance and to overseeengagement with external compensation and benefit matters. It reviews and approves compensation policies for Agenus to ensure that our compensation strategy supports organizational objectives and stockholder interests and does not create incentives for inappropriate risk-taking.consultants. The committee reviews, determines and approves the compensation of the Chief Executive Officer, and reviews and approves the compensation of all other executive officers and certain other key employees. It also reviews and recommends compensation for members of the Board. Additionally, the committee approves and recommends, and suggests material changesmakes recommendations to any employeethe Board regarding the adoption of new incentive compensation or retirementand equity-based plans and any directoradministers existing incentive compensation and equity-based plans.

The Compensation Committee considers appropriatedata from other companies for compensation comparison purposes and retained an outside compensation consultant in 2015, Independent Stock Plan Advisors, LLC2023, Aon Consulting, Inc. through its Human Capital Solutions Subdivision (“ISP”), and in 2016, Radford, an Aon Hewitt Company—a division of Aon Corporation (“Radford”), to provide market reference information forreview the Company's compensation philosophy, create a relevant comparator peer group based on a number of relevant factors, and benefits.evaluate our executive and board compensation programs. The committee has the authority to retain special legal, accounting, or other consultants to advise the committee.committee on executive and board compensation issues that may arise. The committee also has the authority to delegate to subcommittees any responsibilities of the full committee. The Compensation Committee charter is posted on the corporate governance section of our website athttp:https://investor.agenusbio.com/corporate-governance. No material on our website is part of this proxy statement. Please also see the Compensation Discussion and Analysis starting on page 17, and the accompanying Compensation Committee Report on page 32. ISP did, andAon Radford does not provide any services to the Company or the Compensation Committee other than those described above. After consideration of the six independence assessment factors provided under the listing rules of NASDAQ,Nasdaq, the Compensation Committee determined that ISP,Aon Radford, as an advisor to the Compensation Committee during 2015,2023, was independent and that the work performed by ISPAon Radford did not raise any conflicts of interest in 20152023 that would preclude the Compensation Committee from reviewing and considering ISP’sAon Radford’s analyses when making compensation decisions. The Compensation Committee performed the same analysis with respect to Radford and reached the same conclusion.

Corporate Governance and Nominating Committee

|

Members:

Timothy R. Wright, Chair

Brian Corvese

Ulf Wiinberg

The Corporate Governance and Nominating Committee consists entirely of independent directors within the meaning of applicable NASDAQNasdaq listing rules. During 2015,2023, the Corporate Governance and Nominating Committee consisted of Mr. Wright (Chair), Ms. SharpMr. Corvese and Mr. Dechaene. Mr. Dechaene retired from the Board on December 31, 2015, and Ms. Sharp joined the Corporate Governance and Nominating Committee on June 25, 2015.Wiinberg. The Corporate Governance and Nominating Committee is responsible for recommending to the Board policies relating to the conduct of Board affairs, the process for annual evaluation of the Board and the Chief Executive Officer, issues of corporate public responsibility, and overseeing the Company’s management succession planning process. It periodically evaluates the composition of the Board and its committees, the contributions of individual directors, and the Board’s effectiveness as a whole. The committee reviews the Company’s ethics and compliance activities under the Code of EthicsBusiness Conduct and meets periodically with our Chief Compliance Officer, including meeting, as needed, for separate private sessions with the Chief Compliance Officer without other members of management present.Ethics.

The Corporate Governance and Nominating Committee recommends to our full Board individuals to serve as directors. The committee recommends to the Board guidelines and criteria for Board membership and reviews with the Board, on a periodic basis, the appropriate skills and characteristics required of Board members in the context of the then current needs of Agenus. The committee is responsible for reviewing with the Board the appropriate personal characteristics and professional competencies preferred of Board members, who are expected to work together as a team to properly oversee our strategies and operations. In general, all directors are expected to possess certain personal characteristics necessary to create a highly functional and collegial

15

Board, which include personal and professional integrity, practical wisdom and mature judgment, an inquisitive and objective perspective, and time availability for performing the duties of a director.

The Board, as a group, is expected to encompass a range of talents, ages, skills, diversity, and expertise sufficient to provide sound and prudent guidance with respect to the operations and interests of our business. Examples of desired professional competencies include accounting and financial literacy, clinical drug development experience, industry knowledge, medical or scientific knowledge, and management experience. When evaluating potential new Board appointments, the Corporate Governance and Nominating Committee considers these factors, but does not have any fixed criteria for candidates it recommends because the Board believes that a flexible evaluation process allows the committee to make sound judgments based on the needs of the organization and specific attributes of each candidate without a need for a formal policy on diversity.current. Candidates should also be enthusiastic about service on our Board and working collaboratively with existing Board members to create value for all of our stockholders.

The Corporate Governance and Nominating Committee does not have a formal policy with regard to the consideration of director candidates recommended by stockholders because it does not believe such a policy is necessary given that no unaffiliated stockholder has ever recommended a director candidate. When considering director candidates, the Corporate Governance and Nominating Committee, in consultation with the Chief Executive Officer and full Board, considers the current strengths on the existing Board, the current needs of the organization, and anticipated future activities and requirements of both the Board and the organization as a whole. Historically, director candidates have been generally identified primarily through referrals and the executiveexpansive and diverse professional network pool of the Board and senior executives. If the committee were to receive a recommendation for a director candidate from a stockholder, the committee expects that it would evaluate such a candidate using the criteria described above. The committee will consider a recommendation only if appropriate biographical information and background material is provided on a timely basis, accompanied by a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our

common stock for at least one year as of the date that the recommendation is made. To submit a recommendation for a nomination, a stockholder may write to the Lead Director, Agenus Inc., 3 Forbes Road, Lexington, Massachusetts 02421, Attention: Lead Director c/o Chief Compliance Officer.Director.

In addition, our by-lawsbylaws permit stockholders to nominate individuals, without any action or recommendation by the committee or the Board, for election as directors at an annual meeting of stockholders. For a description of this by-law provision, see Additional Information on page 70 of this proxy statement. The committee updated its charter of the Corporate Governance and Nominating Committee in 2022, which is posted on the corporate governance section of our website athttp:https://investor.agenusbio.com/corporate-governance. No material on our website is part of this proxy statement.

Affiliate Transactions Committee

Members:

Susan Hirsch

Timothy R. Wright

Given our 63% ownership of MiNK common stock, the Board determined that it was advisable to create a new, independent committee of the Board to evaluate and negotiate material transactions or matters with respect to which a conflict of interests exists or would reasonably be expected to exist between the Company, on the one hand, and MiNK on the other hand. In March 2023, the Board approved the Affiliate Transactions Committee Charter. The Affiliate Transactions Committee consists entirely of independent directors within the meaning of applicable Nasdaq listing rules and who are disinterested with respect to MiNK. During 2023, the Affiliate Transactions Committee consisted of Ms. Hirsch and Mr. Wright.

Our Affiliate Transactions Committee Charter is posted on the corporate governance section of our website at https://investor.agenusbio.com/corporate-governance. No material on our website is part of this proxy statement.

Nasdaq Diversity Matrix

The following matrix provides race/ethnicity, as well as gender, of the members of our Board, as self-identified by members of our Board.

Board Diversity Matrix (As of April 26, 2024)

Total Number of Directors: 6

16

|

| Female |

| Male |

| Non-Binary |

| Did Not Disclose Gender |

Part I Gender Identity |

|

|

|

|

|

|

|

|

Directors |

| 2 |

| 4 |

| - |

| - |

Part II: Demographic Background |

|

|

|

|

|

|

|

|

African American or Black |

| - |

| - |

| - |

| - |

Alaskan Native or Native American |

| - |

| - |

| - |

| - |

Asian |

| - |

| - |

| - |

| - |

Hispanic or Latinx |

| - |

| - |

| - |

| - |

Native Hawaiian or Pacific Islander |

| - |

| - |

| - |

| - |

White |

| 2 |

| 3 |

| - |

| - |

Middle Eastern |

| - |

| - |

| - |

| - |

Scandinavian |

| - |

| 1 |

| - |

| - |

Two or More Races or Ethnicities |

| - |

| - |

| - |

| - |

LGBTQ+ |

| - |

| - |

| - |

| - |

Did Not Disclose Demographic Background |

| - |

| - |

| - |

| - |

Communications with the Board

You may contact the Board or any committee of the Board by writing to Board of Directors (or specified committee), Agenus Inc., 3 Forbes Road, Lexington, Massachusetts 02421, Attn: Lead Director c/o Chief Compliance Officer.Director. You should indicate on your correspondence that you are an Agenus stockholder. Communications will be distributed to the Lead Director, the appropriate committee chairman, or other members of the Board or executive management, as appropriate, depending on the facts and circumstances stated in the communication received. Executive management will generally determine the proper response to inquiries of a commercial nature, which generally will not be forwarded to the Lead Director. Inquiries regarding accounting, internal controls over financial reporting, or auditing matters will be forwarded to the Chair of the Audit and Finance Committee, and inquiries involving matters governed by the Code of Business Conduct and Ethics will be forwarded to the Chair of the Corporate Governance and Nominating Committee and the Chief Compliance Officer.Committee.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee for the year ended December 31, 20152023 were Mr. JordanCorvese (Chair), Mr. Corvese,Dr. Jeynes-Ellis, and Mr. Wright. No member of the Compensation Committee was at any time during 2015,2023, or formerly, an officer or employee of Agenus or any subsidiary of Agenus. No executive officer of Agenus has served as a director or member of a compensation committee (or other committee serving an equivalent function) of any other entity while an executive officer of that other entity served as a director of Agenus or member of ourthe Compensation Committee.

Our Executive Officers

Garo H. Armen, Ph. D.—Chairman and Chief Executive Officer—Dr. Armen, 71, has been our Chairman and Chief Executive Officer since our founding in 1994. From our founding until December 2019, Dr. Armen also served as our President. Additional biographical information on Dr. Armen is set forth below.

Steven O’Day, MD—Chief Medical Officer—Dr. O’Day, 63, has been our Chief Medical Officer since January 2021. Dr. O’Day is a pioneer in CTLA-4 inhibition, and has been the principal investigator in more than 200 clinical trials. From 2015 until joining Agenus, was Director of Immuno-Oncology and Director of Clinical Research at John Wayne Cancer Institute at Providence Saint John’s Health Center. Dr. O’Day received his medical degree in 1988 from Johns Hopkins School of Medicine and his BA in Chemistry from Williams College in 1983. Additionally, Dr. O’Day did his medical oncology fellowship at the Dana Farber/Harvard Cancer Center.

Christine M. Klaskin—Vice President of Finance—Ms. Klaskin, 58, has been our Vice President, Finance since October 2006. Since joining Agenus Inc. in 1996 as finance manager, Ms. Klaskin has held various positions within the finance department and has been involved in all equity and debt offerings of the Company including its IPO. Additionally, Ms. Klaskin serves as the Treasurer of MiNK Therapeutics, Inc. Prior to joining Agenus, Ms. Klaskin was employed by Arthur Andersen as an audit manager. Ms. Klaskin received her Bachelor of Accountancy from The George Washington University.

17

Under our bylaws all of our executive officers are elected to their offices on an annual basis until the first meeting of our Board of Directors following our annual stockholder meeting. No family relationships exist among any of our directors or executive officers.

18

COMPENSATION DISCUSSION AND ANALYSIS

This section discusses the principles underlying our policies and decisions with respect to the compensation of ourthe executive officers who are named in the “Summary Compensation Table” below and who are referred to throughout this proxy statement as our “named executive officers,” and the material factors relevant to an analysisunderstanding of these policies and decisions.their compensation in 2023. Our named executive officers for 20152023 are:

•

|

|

Ozer Baysal—Chief Business Officer

Dr. Robert B. Stein—President, Research & Development

Karen H. Valentine—Chief Legal Officer and General Counsel

Executive Summary

This section provides information on the compensation of our named executive officers and the key factors relevant to understanding their compensation in 2023. Our named executive officers for 2023 are Dr. Garo H. Armen, Chairman and Chief Executive Officer; Dr. Steven J. O’Day, Chief Medical Officer; and Ms. Christine M. Klaskin, Vice President of Finance.

Our executive compensation program is designed to attract and retain the highest calibertop talent, reward strong performance, and align incentives with the creation of long-term stockholdershareholder value, taking into considerationwhile also considering the Company’s resource constraints. The target short-term compensation of(base salary and target annual incentive bonuses) for our named executive officers is positioned atcompetitively on average within approximately the 50th50th percentile of our compensation peer group, and ourgroup. Our long-term incentive programs are designed to preserve our cash resources, promoteencourage long-term decision-making and alignvalue creation, and reward with stock price appreciation.

Our performance in 2015

In 2023, we and our subsidiaries exceeded most of our annual goals set under our corporate performance goals. We achieved significant clinical, research, and operational goals, such as completing enrollment in the aggregate, despite challenging circumstances, including limited financialPhase 1 and human resources, aggressive timelinesrandomized Phase 2 studies of botensilimab and third party competition. As more specifically described below, during 2015 we:

filed investigationalbalstilimab in metastatic CRC and successful completion for CQV and manufacturing readiness for clinical production. We opened our new drug applications (“INDs”)commercial manufacturing facility in Emeryville, CA, where, following validation and commissioning, we will transition our manufacturing. Data from our clinical programs were presented at six premiere scientific forums and in five peer-reviewed publications. We launched a Medical Affairs group as a key part of our engagement with key opinion leaders and healthcare professionals. We hired a new commercial lead and launched plans to prepare for antibody candidates targeting GITR (in Incyte’s name) and CTLA-4 and advanced additional antibody candidates targeting OX40 and PD-1;

broadenedeventual commercialization of our asset and technology foundation and secured our own antibody manufacturing capabilities by executing a number of strategic acquisitions;

consummated a global alliance with Incyte Corporation (“Incyte”) and later expanded itlead clinical program. We began engagement with the addition of three new targets;

extended the collaborative research termFDA on aspects of our allianceclinical program, and received Fast Track designation for our lead program of botensilimab and balstilimab in patients with Merck Sharpe & Dohme (“Merck”);

significantly improved our balance sheet by raising approximately $235 million in cash, including a $100 million royalty bond financing relating to QS-21; and

continued to build our teammetastatic CRC, specifically patients with no active liver metastases, previously treated with standard combination of chemotherapy, anti-VEGF and expand our internal capabilities by recruiting top tier talent across the broad spectrum of our business.anti-EGFR, as appropriate.

We believe that our incentive compensation programs were administered in a manner consistent with our operating performance, long-term objectives, and compensation philosophy. GivenBased on the Company’s overall performance in 2015,2023, the annual cashincentive bonuses awarded toearned by our named executive officers for 2015 performance ranged from 111%100% to 170%146% of their targets, andtarget bonus amounts, prior to adjusting for the remaining one-thirdmultiplier applied as a result of the performance-vestingpayment of these bonuses in stock options granted to our named executive officers in 2013 and one-half of the performance-vesting stock options granted to our named executive officers in 2015 vested during 2015 based on the achievement of pre-established milestones relating to our market capitalization.

Compensation Philosophy

Our executive compensation program is designed to attract and retain the highest caliber executives and reward and alignhigh-caliber talent while aligning our executives' incentives with the creation of long-term stockholder value, while effectively managingshareholder value. We aim to manage the risks and challenges inherent to a biotechnology company of our size and stage of development. We offer a compensation package that combinesdevelopment by combining short- and long-term components,elements, cash and equity compensation, and fixed and contingent payments, in the proportions we believe appropriately incent and rewardvariable compensation. We incentivize our executives to achieve the following goals:

createvarious research, clinical, and operational goals, as a means to creating long-term stockholder value;

buildshareholder value, including building a creative and high performinghigh-performing team, whose participants understand and share our business objectives and ethical and cultural values and retain these key team members;

demonstratedemonstrating leadership and innovation, in the identification, development, and commercialization of product candidates that fit our strategic objectives;

effectively manage themanaging multiple dimensions of our business, from research and development, through clinical trials, manufacturing, strategic alliances,identifying and in all aspects of our operations in order to maximize the value of each dollar deployed; and

identify and addressaddressing our short- and long-term financing requirements in a highly strategicoperational needs and creative manner, and deploy available funds for the maximum benefit to our stockholders.financial position.

Our general philosophy is to emphasize equity over cash compensation and long-term over short-term compensation. OurWith respect to our executive compensation program, not only aimswe aim to be competitive inwithin our industry but also to beand fair relative to other professionals within our organization. Our executives’executives' base salary,salaries, target annual incentive bonus levels, and target annual long-term incentive award values are set at levels that are competitive with our peers. Executives have the opportunity to earn above-market pay for above-market performance as measured againstthose of our peer group of companies (see “Competitive Market Review” for further information on our peer group).

group. We continually review our executive compensation program in order to ensure that it rewards executives appropriately and provides compensation at market-competitive levels. See “Competitive Market Review” below for further information on our peer group and other market data used by our Compensation Committee.

We believe that our executive compensation program appropriately rewards our executives for achieving our goals and objectives, in a manner consistent withand provides compensation at market-competitive levels. Our Compensation Committee assessed our company’s philosophycompensation

19

policies and values and our peer group. In designingpractices, including the risks created by our compensation package we also seek to reward executive decisions that align the Company’s goalsplans, and objectives with delivering positive stockholder returns. We evaluate and reward our executives based on the Company’s performance, their contribution to the achievement of short- and long-term goals and objectives, and their ability to take advantage of unique opportunities and overcome difficult challenges within our business. We believe that our mix of short-term and long-term incentives, and our evaluation of performance results, assist us in managing any risk taking that may result from our compensation program and aligning our employees’ behavior with our overall business plan and the interests of our stockholders. Our Compensation Committee has concluded that our current compensation programs do not present no riskrisks that isare reasonably likely to have a material adverse effect on the Company.

At the Company’s 2014 Annual Meeting of Stockholders, our stockholders had the opportunity to cast an advisory vote (a “say-on-pay” proposal) on the compensation of our executive officers as disclosed in our proxy statement for that meeting. Stockholders approved the say-on-pay proposal by the affirmative vote of 96.2% of the votes cast on that proposal. The Compensation Committee believes this affirms stockholders’ support of the Company’s approach to executive compensation, and this approach has not changed since the 2014 Annual Meeting of Stockholders. Our Compensation Committee will continue to consider the outcome of the Company’s say-on-pay votes when making future compensation decisions for our named executive officers. At our 2011 Annual Meeting of Stockholders, our stockholders also had the opportunity to cast an advisory vote (a “say-on-frequency” proposal) on how often the Company should include a say-on-pay proposal in its proxy statements for future annual meetings. Our stockholders approved a proposal to hold say-on-pay votes every three years. Accordingly, our Board adopted the policy to hold say-on-pay votes every three years until the next required “say-on-frequency” advisory vote, and therefore, our stockholders will have the opportunity to vote on both “say-on-pay” and “say-on-frequency” proposals next year at our 2017 Annual Meeting of Stockholders.

Competitive Market Review

The market

To compete for top tiertop-tier executive talent in the biotechnology industry, is highly competitive. In order to attract and retain a superior leadership team we need to draw upon a pool of talent that is highly sought after by both large and established pharmaceutical and biotechnology companies in and outside our geographic area and by other life science companies.

We believe we have a competitive advantage in our ability to offer significant upside potential through stock options and other equity-based awards. In addition, we offer market cash compensation levels through competitive base salaries and cash bonus opportunities. We also compete on the basis of our vision of future success, our culture and values, the cohesiveness and productivity of our teams, and the excellence of our scientists and management personnel.

In order to succeed in attracting highly talented executives, we continuously monitor market trends and draw upon compensation surveys prepared by theAon Radford, Surveys division of AON Hewitt,our Compensation Committee’s independent compensation consultant, custom research developed by our compensation consultants, ISP for 2015 andAon Radford, for 2016, and other nationally recognized compensation surveys. Our Compensation Committee reviewsengages Aon Radford annually to evaluate our executive compensation program and compare it to other programs in the market. We defined our market using two market references for 2023: the Radford Global Life Sciences Survey and proxy data that analyzes various cross-sectionsfrom a peer group of biotechnology companies. Our Compensation Committee approves a group of comparable companies as our industry as well as relevant geographical areas.peer group for executive and director compensation purposes.

Market References: How We Define Market and How We Use Market Compensation Data. Our Compensation Committee has engaged ISP andAon Radford since 2016 as its independent compensation consultantsconsultant to evaluate our totalexecutive compensation program and compare it to levelsother programs in the market.

Defining the Market.For 2015,2023, we used two market references to compareevaluate our totalexecutive compensation practices and levels toprogram against those in the market:

On an annual basis, our compensation consultant recommends, and our Compensation Committee approves, a group of comparable companies as our peer group for executive and director compensation purposes. In 2022, our Compensation Committee worked closely with Aon Radford to review, evaluate and develop our peer group with an emphasis on biotechnology and pharmaceutical companies with a similar headcount and market capitalization. Based on this analysis and discussions with Aon Radford, our Compensation Committee did not make any updates to our 2022 peer group for 2023. Our peer group for 2022 and 2023 was as follows:

2022 and 2023 Peer Group | |

Arcus Biosciences, Inc. | |

Arvinas, Inc. | |

Atara Biotherapeutics, Inc. | |

Deciphera Pharmaceuticals, Inc. | |

Fate Therapeutics, Inc. | |

ImmunoGen, Inc. | |

Inovio Pharmaceuticals, Inc. | |

Instil Bio, Inc. | |

Iovance Biotherapeutics, Inc. | |

Karyopharm Therapeutics Inc. | |

MacroGenics, Inc. | |

Mersana Therapeutics, Inc. | |

Precision BioSciences, Inc. | |

Seres Therapeutics, Inc. | |

SpringWorks Therapeutics, Inc. | |

Syndax Pharmaceuticals, Inc. | |

TG Therapeutics, Inc. | |

Voyager Therapeutics, Inc. | |

Zentalis Pharmaceuticals, Inc. | |

ArQule, Inc.

Array BioPharma Inc.

AVEO Pharmaceuticals, Inc.

BioCryst Pharmaceuticals, Inc.

Cell Therapeutics, Inc.

Curis, Inc.

Cytokinetics, Incorporated

GTx, Inc.

Idera Pharmaceuticals, Inc.

Immunomedics, Inc.

Infinity Pharmaceuticals, Inc.

Omeros Incorporated

Pain Therapeutics, Inc.

Peregrine Pharmaceuticals, Inc.

Sunesis Pharmaceuticals, Inc.

Synta Pharmaceuticals Corp.

Trubion Pharmaceuticals, Inc.

Vical, Inc.

ZIOPHARM Oncology, Inc.

Determining Market Levels and Specific Comparisons. We compare our practicesexecutive compensation program and amounts of compensation against our peer group by reviewing each compensation component by(measured at target in the case of annual and long-term incentive opportunities) and total annual compensation (including target annual incentive opportunity) and by total compensation including equity compensation components.compensation. The competitive comparisons made in this process are used to determine our approximate position relative to the appropriate market reference by each element of compensation component and in total.

20

Total Compensation Strategy

We intend

Our compensation strategy aims to continueoffer our strategy of compensating our named executive officers atexecutives competitive levels,compensation packages, with thean opportunity to earn above-market pay for above-marketexceptional performance. We will continue to emphasizeTo maintain our competitive pay philosophy, we prioritize long-term equity incentives and performance-based incentive compensation delivered in the form of equity-based awards to maintain our competitive pay philosophy.compensation.

For 2015, the

We generally target total compensation paid toat approximately the named executive officers generally fell between the 50th and 60th50th percentile of total compensation paid to executives holding equivalent positions in our peer group, of companies. Totalwhich was the case for 2023 target total compensation. For this purpose, total compensation includes annual base salary, target cashannual incentive bonus, and the grant date value of equity awards. We believe that the total compensation paid to our named executive officers was reasonable in the aggregate given our corporate performance and our financial circumstances.

The competitive posture of our totalactual annual compensation paid or earned versus the market references will vary year to year based on Company and individual performance, as well as the performance of theour peer group companies and theirthe respective levellevels of annual performance bonus awards madecompensation paid by peer group companies to their executives. We expect to continue targeting total compensation at approximately the 50th50th percentile of our peer group, with an emphasis on performance-based variable compensation. Further, in light of our compensation philosophy, we believe that the total compensation package for our executives should continue to consist of base salary, annual incentive awards (bonus),bonuses, long-term equity-based incentive compensation, and certain other benefits.

Role of Our Compensation Committee

Our Compensation Committee approves, administers, and interprets our executive compensation and benefit policies, including awards that have been made to executives under our 1999 Equity Incentive Plan (as amended) and under our 2009 Equity Incentive Plan, as amended to date (the “2009 Equity Incentive Plan”). Our Compensation Committee is appointed by our Board, and consists entirely of directors who are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and “non-employee directors” for purposes of Rule 16b-3 under the 1934 Act. Our Compensation Committee is comprised of Mr. Jordan (Chair), Mr. Corvese and Mr. Wright.

Our Compensation Committee ensures that our executive compensation program is consistent with our compensation philosophy and our Governance Guidelines (described above), and determines the executive compensation packages offered to our officers.

Executive Compensation Program

Components of our Executive Compensation Program

Our executive compensation program consists of the following four components (each described in more detail below):

•

•

•

•

To determine levels of overall executive compensation, thein addition to considering market data as described above, our Compensation Committee balances individual experience, performance and functional area, and company-wide goals and achievements. For purposes of setting the annual goals under our annual bonus program, each executive participates in establishing the objectives of our Company as a whole and offers his or her views as to the goals of each other’s functional area, insofar as those goals impact the individual executive’s own functional area. After the end of the relevant fiscal year, we also ask our executives to provide feedback not only on their own performance and that of their particular area, but also of other functional areas and our entire organization. We see this process both as the optimal means of assembling accurate information regarding the expectation and realization of performance, as well as an integral part of our culture of collaborative, team-oriented management. Final goals and objectives for our annual bonus program are approved by the Board.

In 2015, our Company goals included:

File INDs for two or more checkpoint modulaters (“CPMs”);

Advance IND enabling studies for two or more additional CPMs sufficient to file INDs in 2016;

Finalize registration strategy for Prophage in newly diagnosed glioblastoma multiforme (“ndGBM”);

Consummate a global alliance for our CPMs and extend our Merck alliance;

Expand, strengthen and optimize our antibody discovery engine through strategic acquisitions and in-licenses;

Raise funds required to aggressively advance our strategic initiatives and key programs, including monetizing non-core assets; and

Close key capability gaps and continue to grow the organization with world class talent.

At the end of each year, we and our Compensation Committee evaluate the achievement of Company goals and objectives, along with individual executive performance, and begin discussions regarding goals and objectives for the next fiscal year. Incentive compensation, based on the achievement of goals and objectives, may be awarded in the form of an annual cash bonus and equity-based awards. Equity-based awards are used to align the interests of our executives with those of our stockholders and to promote a long-term performance perspective and progress toward achieving our long-term strategy.

Our senior executives’ total compensation may vary year to year based on Company and individual performance. Further, the value to our senior executives of equity awards will vary based on our stock price performance. The general structure of our executive compensation programs for executive officersprogram is consistent with that offor non-executive members of the Agenus management team. Perquisites are not a general component of our compensation program for all executives; however, we provide Dr. Armen with car services, and we provide Dr. Stein with access to corporate housing, housing and automobile allowances and financial planning and advisory services, all as noted below.

Short-term Compensation.

Short-Term Compensation

Our short-term compensation program consists of base salary and annual incentive bonuses. Base salary will typically be usedprovides a fixed rate of base compensation to recognize the experience, skills, knowledge, and responsibilities required of each officer, as well asexecutive, and takes into account competitive market conditions.

Base Salary:Salary: Base salaries for our executivesexecutive officers are generally positioned at or around the 50th50th percentile versusof our peer group (see “Competitive Market Review” above for further information on our peer group). In

establishing the base salaries of our executive officers,executives, our Compensation Committee (with input from our CEO,Chief Executive Officer, other than with respect to his own base salary) takes into account a number ofconsiders various factors, including the executive’ssuch as an executive's seniority, experience, position and functional role and level of responsibility.responsibilities, as well as peer group and competitive market data.

We also consider the following factors when determining base salary:

For newly hired personnel,executives, we also consider the base salary of the individual at his or her prior employment and any relevant unique personal circumstances that motivated them to join Agenus and what we have historically paid for the executivesame or similar roles, in addition to leave that prior position and join Agenus. In addition, we consider the competitive marketbase salaries for corresponding positions within comparable companies of similar sizeour peer group and stage of development.

For individualsthe competitive market. When executives are newly promoted to a position, we also consider the competitive market and their prior salary and experience. Where these individuals mayexperience, along with base salaries for corresponding positions within our peer group and the competitive market. If an executive does not have the same level of experience at the time of promotion as a counterpart hired from outside the Company would, we may implement a multi-step approach to bringing their salariesbase salary in line with targeted levels. SalaryBase salary increases at each of these steps will be contingent on the continued goodstrong performance of the individual.executive.

The

We review the base salaries of our named executive officers are reviewed on an annual basis,executives annually and adjustments are madeadjust them to reflect performance-based factors, as well asthe executive’s performance, competitive conditions.market conditions, and market data. Increases are considered within the context of our overall annual financial position before more specific individual and market competitive factors are considered. We do not applyuse specific formulas to determine base salary increases.

21

In June 2015,January 2023, in connection with its annual review of executive compensation matters and approval of annual long-term incentive awards for all employees, our Compensation Committee approved increases to the Board approved abase salaries of our named executive officers. Dr. Armen’s base salary increase for each ofincreased from $687,750 to $715,260 (a 4% increase), Dr. Armen, Ms. Klaskin, Dr. SteinO’Day’s base salary increased from $572,000 to $594,880 (a 4% increase), and Ms. ValentineKlaskin’s base salary increased from $286,754 to $298,224 (a 4% increase). These increases were effective as of July 1, 2015,March 6, 2023.

Named Executive Officer |

| 2023 Base Salary |

| |

Dr. Armen |

| $ | 715,260 |

|

Dr. O’Day |

| $ | 594,880 |

|

Ms. Klaskin |

| $ | 298,224 |

|

In August 2023 our Compensation Committee approved paying Dr. Armen’s base salary in fully vested shares of our stock, in lieu of cash, for the remainder of 2023. In January 2024, the Compensation Committee authorized an extension of this arrangement, and Agenus will continue to pay Dr. Armen’s base salary in stock, in lieu of cash, through the first half of 2024.

In January 2024, in connection with its annual review of executive compensation matters and approval of annual long-term incentive awards for all employees, our Compensation Committee elected not to approve an increase to the salaries of our named executive officers, and as described below under “Compensation Actions fora result, the current salaries of our Named Executive Officers.”named executive officers remain unchanged from their 2023 levels.